INP-WealthPk

Qudsia Bano

Economic downturns sometimes prove to be a blessing in disguise, so companies should invest during this lean period to ensure profits when the economy comes out of depression, said Abbas Haider, Finance Manager at Chase Securities Pakistan Private Limited, during an interview with WealthPK.

WealthPK: How did the capital market fare in 2022?

Abbas Haider: Devaluing rupee, growing inflation and uncertainty on political and economic fronts stalled the corporate activity in the country during 2022, which translated into an unstable capital market. The equity market index recorded a 14% decline from its June 30, 2021 closing of 47,356 points to its June 30, 2022 closing at 41,540 points.

WealthPK: How long will the present economic downturn last?

Abbas Haider: History is a witness to the fact that downturns typically last a short time and are followed by protracted periods of expansion. The businesses that seize the opportunity and pay the correct rates to acquire the right assets, clients, personnel, and capabilities succeed in these trying times. Additionally, this is a good time for enterprises to speed up their digital transformation.

WealthPK: What initiatives does your company take to sustain clientele?

Abbas Haider: Chase Securities Pakistan (Private) Limited has established a research department with a focus on mid and small-cap equities, which are under-reported yet have strong return potential. We will build a full-service securities broking firm with the aid of our local network of connections with corporate and institutional clients.

WealthPK: What are the main macroeconomic factors that are affecting the stock market?

Abbas Haider: Events, trends, or situations that relate to and have an impact on a sizable portion of an economy are known as macroeconomic factors. They may fall under the economic, geographical, or natural categories, to name a few. Macroeconomic issues include things like interest rates, unemployment, and national productivity.

The effects of macroeconomic conditions on various businesses and industries might vary widely. They also contribute to the broader perception of an industry or an economy. Before making a final investment choice, taking these aspects into account is a logical next step after conducting a basic examination of a company. In a portfolio, it can reduce risk and boost gains.

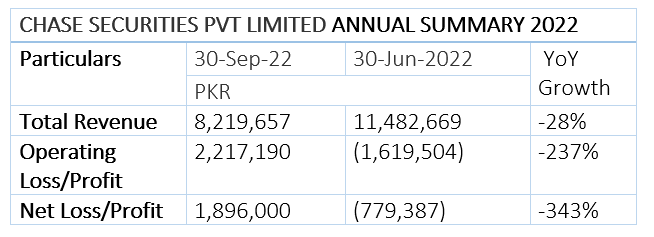

Performance in 1QFY23

During the first quarter of fiscal year 2022-23, the company’s revenue decreased to Rs8.2 million from Rs11.4 million recorded in the last quarter of fiscal 2021-22, posting a decrease of 28%. The operating profit for the quarter stood at Rs2.2 million, registering a gain of 237% over an operating loss of Rs1.6 million in 4QFY22. The profit-after-tax for 1QFY23 jumped to Rs1.89 million, a massive 343% growth over the net loss of Rs0.779 million in 4QFY22.

About the company

Chase Securities Pakistan (Private) Limited is a company set up by a team of capital market professionals to conduct securities broking business. The company primarily targets to increase the investor base of the market by conducting investor awareness sessions and adopting digital marketing strategies. The company aims to leverage technology to build a new client base by developing interactive online trading portals and applications.

Credit : Independent News Pakistan-WealthPk