INP-WealthPk

Muhammad Asad Tahir Bhawana

Pakistan's economy has been facing significant challenges, including high inflation and slow economic growth. However, recent government stabilisation policies seem to be producing some positive results, according to the Monthly Economic Outlook report of the Ministry of Finance.According to the report, a surplus was recorded on balance of payments (BOPs) current account, which might reduce external

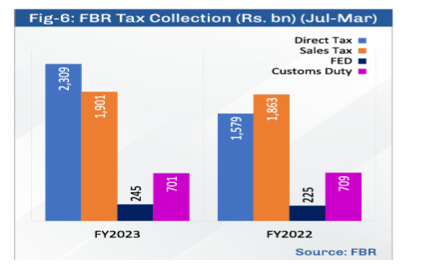

financing constraints, increase exchange rate stability, and boost economic confidence. Pakistan's total liquid foreign exchange reserves stood at $10 billion on April 26, 2023, with the State Bank's reserves totaling $4.4 billion and the commercial bank's $5.6 billion. In addition, Federal Board of Revenue’s net provisional tax collection during the first nine months of this fiscal year grew by 18% to Rs5.156 trillion against Rs4.376 trillion in the same period last year. For the month of March, net provisional tax collection increased by 15% to Rs662 billion from Rs574 billion in the comparable period last year.

The agricultural sector has also seen a rise in wheat production this year. The Federal Agriculture Committee, which met on April 12, reviewed the latest agricultural performance for Rabi season 2022-23. According to the committee, wheat production for 2022-23 increased by 1.6% to 26.81 million tonnes from an area of nine million hectares compared to last year.

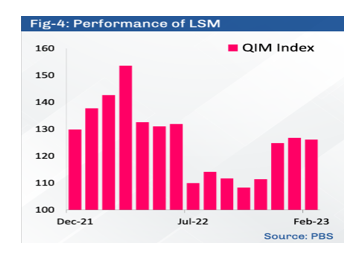

However, some sectors are still facing challenges and their growth is slowing down. The Large-Scale Manufacturing (LSM) sector, for example, contracted 5.56% from July to February 2023. A number of factors contributed to this decline, such as synchronised policies to address imbalances, disruptions in supply chains, and global recessionary pressures. A year-on-year decline of 11.6% was recorded by LSM in February 2023. In spite of this, four sectors showed positive growth, including wearing apparel, leather products, furniture, and others (football).

Moreover, inflation in March rose to 35.4% from 31.5% the previous month. Month-over-month, it increased by 3.7% in March, compared to 4.3% a month earlier. Foreign direct investment (FDI) reached $1.04 billion during July-March FY23, a decrease of 22.5% from $1.35 billion last year. The highest FDI was received from China, which accounted for $319.2 million (30.4%) followed by Japan with $153 million or 15%.

Furthermore, worker remittances decreased by 10.8% to $20.5 billion in July-March 2023, compared to $23 billion in July-March 2022. However, on a MoM basis, remittances increased by 27.4% to $2.3 billion in March 2023 compared to $1.98 billion in February 2023. The highest remittances came from Saudi Arabia at 23.9% of the total followed by 17.5% from UAE.The report noted that delay in completion of the ninth review of the IMF loan programme was putting pressure on the country’s external sector.

Credit: Independent News Pakistan-WealthPk