INP-WealthPk

Jawad Ahmed

Bestway Cement Limited's net revenues rose 27.27% to Rs72.3 billion in the financial year 2021-22 from Rs56.8 billion the previous year. The higher income was attributed to an increase in selling prices required by an outrageous increase in input costs, according to the company’s latest financials filed with the stock exchange. The company is a subsidiary of Bestway International Holdings Limited (BIHL), which holds 56.43% of its shares.

Due to an increase in revenue, gross profit for the year increased 38.5% to Rs23 billion from Rs16.6 billion the previous year. The year's profit-before-tax reached Rs19.3 billion as opposed to Rs15.5 billion in FY21. The company's profit margins were squeezed despite strong topline growth due to high sales expenses and 10% super tax, as the profit-after-tax fell 11.57% to Rs10.2 billion from Rs11.5 billion during the two comparable periods, lowering the earnings per share (EPS) to Rs17.17 from Rs19.42, reports WealthPK, quoting the company’s financial stats.

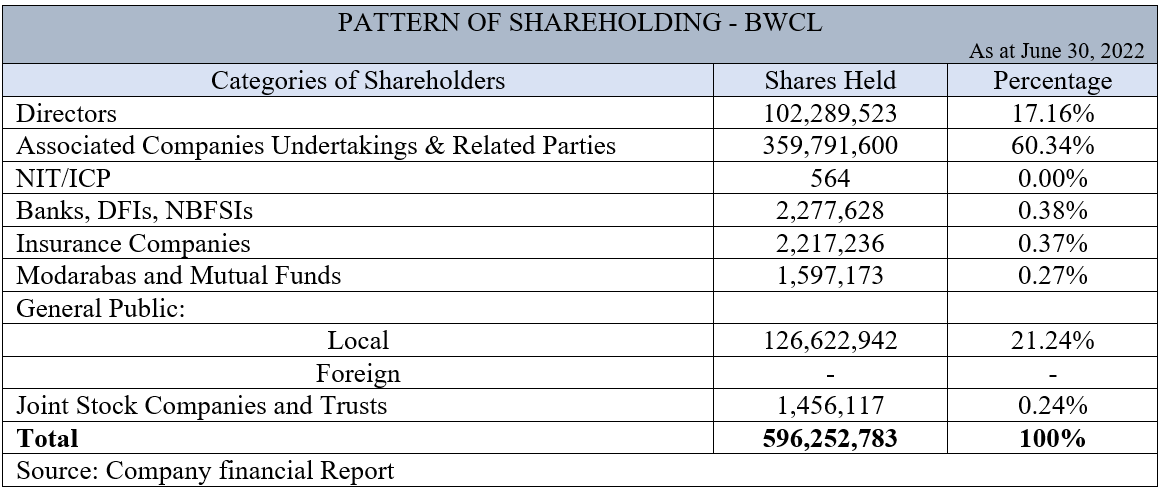

Shareholding pattern

As of June 30, 2022, the company's directors owned 17% of the stock, while affiliated companies possessed about 60%. Around 21% of the shares were owned by the general public (local). Banks, DFIs, and NBFIs, insurance companies, Modarabas, joint stock companies and trusts collectively owned almost 2% of the stock.

Future Outlook

The Pakistan’s economy is significantly influenced by soaring global commodity prices, current account deficit, declining foreign exchange reserves, and hyperinflationary scenario. Furthermore, the damage caused by the recent floods will limit any possibilities of the economic recovery. All of these concerns will cause significant challenges for the economy in the upcoming year, particularly for the construction sector. According to the company’s financial report, Bestway is significantly better equipped to face off any headwinds than most of its rivals because it is not only one of the lowest cost producers in the country but also has a low level of debt. The company is constantly aware of potential obstacles and will continue to proactively adapt in order to guarantee its peak performance and superior profits for its shareholders.

Credit: Independent News Pakistan-WealthPk