INP-WealthPk

Fakiha Tariq

Azgard Nine Limited (ANL) maintained its legacy of staying profitable during the first quarters (July-Sept) of last three financial years by earning decent gross and net profits in the first three months of the ongoing financial year 2022-23, a study conducted by WealthPK shows. Incorporated as a public limited company in 1993, Azgard Nine Limited is a member of textile composite sector with the symbol “ANL” registered on the Pakistan Stock Exchange.

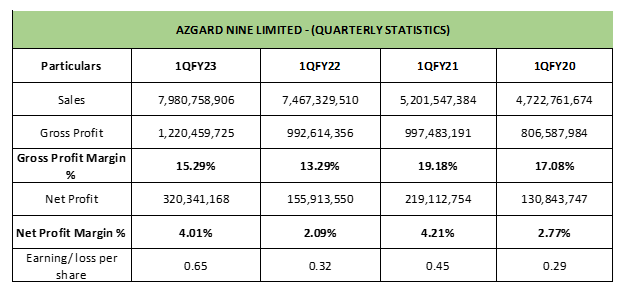

ANL is primarily engaged in the manufacturing and selling of denim products. The company’s head office is located in Lahore with two manufacturing plants in operations currently. In 1QFY23, ANL earned 15.29% or Rs1.2 billion of gross profit over sales of Rs7.9 billion. The company earned net profit of Rs320 million with earnings per share (EPS) of Rs0.65 during the July-Sept period of FY23.

Compared to the same quarter of FY22, ANL’s gross profit and net profit ratios grew by 15% and 92%, respectively. The gross sales moved up by 7% from 1QFY22 to 1QFY23. The WealthPK analysis observed an increasing trend in ANL’s gross sales values in the first quarters of last three fiscals.

In comparison to the first quarters of last three years, ANL made highest sales of Rs9 billion in 1QFY23, whereas sales for 1QFY22, 1QFY21 and 1QFY20 stood at Rs7.4 billion, Rs5.2 billion and Rs4.7 billion, respectively.

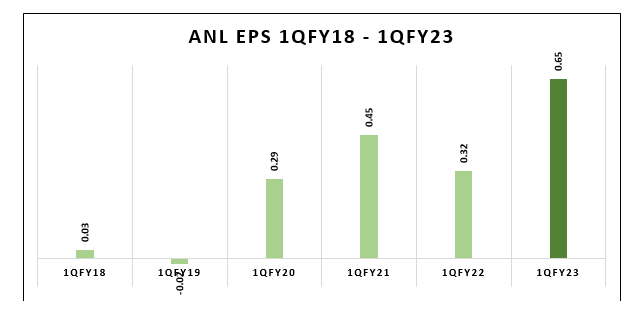

ANL: EPS comparison – FY18 to FY23

In comparison to the same quarters of last five fiscal years, ANL recorded highest EPS value of Rs0.65 in 1QFY23. With a decline in EPS value from 1QFY18 to 1QFY19, ANL experienced two consecutive years of EPS rise in 1QFY20 and 1QFY21. ANL’s EPS of Rs0.65 in 1QFY23 represented 103% growth over EPS value of Rs0.32 in the first quarter of FY22.

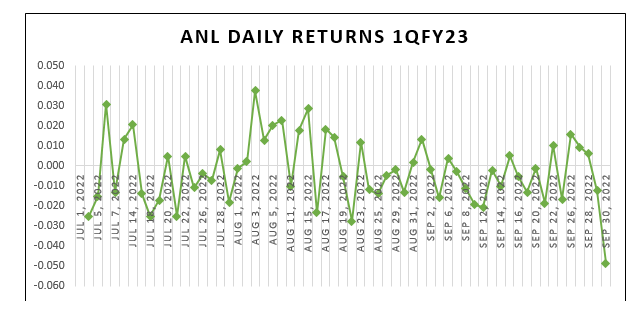

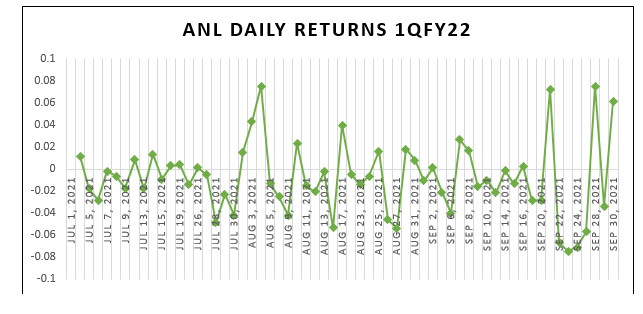

ANL daily stock returns - 1QFY23 vs 1QFY22

When compared to the daily stock returns of the first quarter of FY22, ANL produced more positive return spikes for its investors in 1QFY23. The company enjoyed positive returns in August 22. However, the 1QFY23 ended in giving negative returns.

In the 1QFY22, the daily stock returns showed high positive spikes by the end of the quarter.

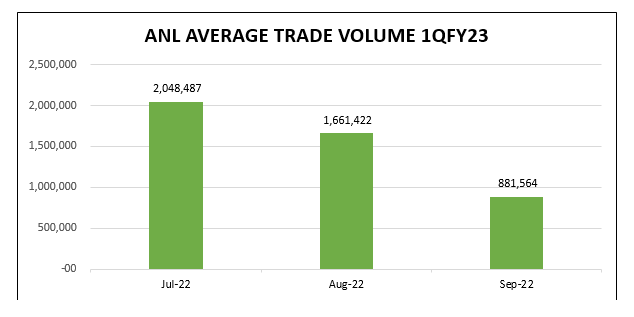

A declining trend was seen in the average traded volume in 1QFY23. An average decrease of 57% was witnessed in the traded volume.

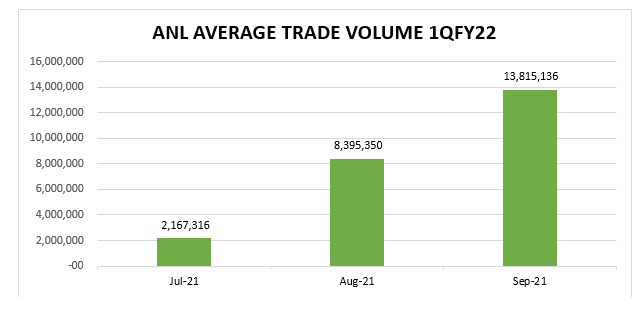

However, the average traded volume of ANL stocks in the first quarter of FY22 showed a continuous increasing trend.

Credit : Independent News Pakistan-WealthPk