INP-WealthPk

Hifsa Raja

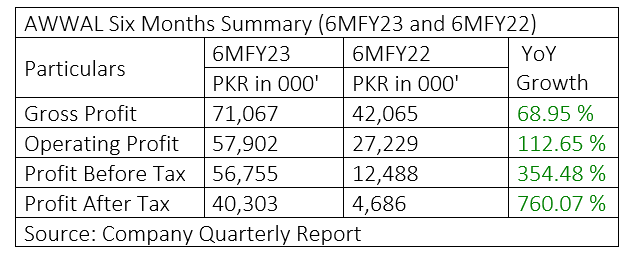

Awwal Modaraba Management Limited’s (AWWAL) gross profit increased 68.95% to Rs71 million in the first six months of fiscal year 2022-23 (6MFY23) from Rs42 million over the corresponding period of the previous fiscal. Similarly, the company’s operating profit increased by 112.65% to Rs57.9 million in 6MFY23 from Rs27.2 billion in 6MFY22. The profit-before-taxation jumped 354.48% to Rs56.7 million from Rs12.4 million in 6MFY22. The profit-after-taxation also jumped 760.07% to Rs40.3 million in 6MFY23 from Rs4.68 million in 6MFY22, reports WealthPK.

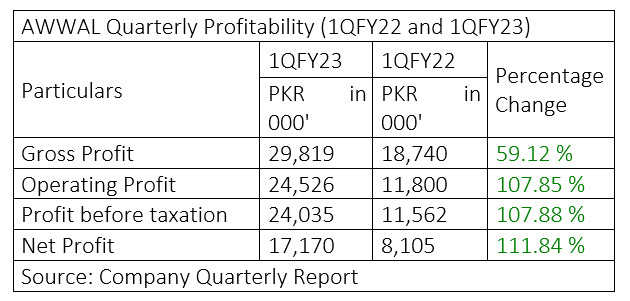

AWWAL – 1QFY23 (July-Sept)

In the first quarter of FY23, AWWAL’s gross profit increased by 59.12% and net profit by 111.84% compared to the same period of FY22. The company posted gross profit of Rs29.8 million and operating profit of Rs24.5 million in 1QFY23.

The company posted a net profit of Rs17.1 million in 1QFY23.

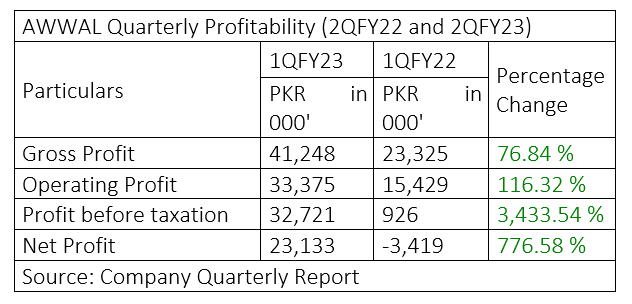

AWWAL – 2QFY23 (Oct-Dec)

In the second quarter of FY23, AWWAL’s gross profit increased by 76.84% and operating profit by 116.32% compared to the same period of FY22. During this quarter, AWWAL posted gross profit of Rs41.2 million, and operating profit of Rs33.3 million.

The company posted a net profit of Rs23.1 million in 2QFY23.

Industry comparison

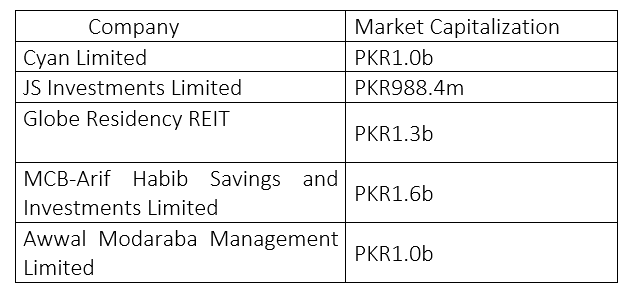

Cyan Limited, JS Investments Limited, Globe Residency REIT, and MCB-Arif Habib Savings and Investments Limited are the rivals of Awwal Modaraba Management Limited in terms of market capitalisation. MCB-Arif Habib Savings and Investments Limited has the largest market capitalisation of Rs1.6 billion followed by Globe Residency’s Rs1.3 billion. The market value of Awwal Modaraba is Rs1 billion.

Company profile

Awwal Modaraba was floated under the Modaraba Companies and Modaraba (Floatation and Control) Ordinance, 1980. It is a perpetual, multi-purpose and multi-dimensional modaraba and is primarily engaged in providing working capital, term finance, Ijarah, Musharika, Morabaha and other Shariah-compliant investment/instruments to credit worthy customers.

Credit: Independent News Pakistan-WealthPk