INP-WealthPk

Fakiha Tariq

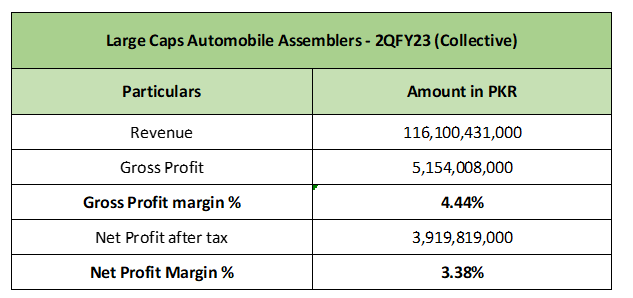

Large cap automobile assemblers collectively earned gross profit of Rs5.1 billion and net profit of Rs3.9 billion on sales of Rs116 billion in the second quarter (Oct-Dec) of the ongoing fiscal year 2022-23, WealthPK reports. Indus Motor Company Limited (INDU) is the largest firm with market cap of Rs71.1 billion followed by Millat Tractors Limited (MTL) with market cap of Rs67.6 billion.

Atlas Honda Limited (ATLH) is the third and Honda Atlas Cars (Pakistan) Limited (HCAR) the fourth largest firm of the sector with market caps of Rs32.3 billion and Rs15.8 billion, respectively. Al-Ghazi Tractors Limited (AGTL) is the fifth largest firm holding market cap of Rs15.1 billion. Large cap auto firms ended the second quarter of the current fiscal (2QFY23) with gross profit and net profit ratios of 4.44% and 3.38%, respectively.

Large Auto Assemblers– Financial Comparison – 2QFY23

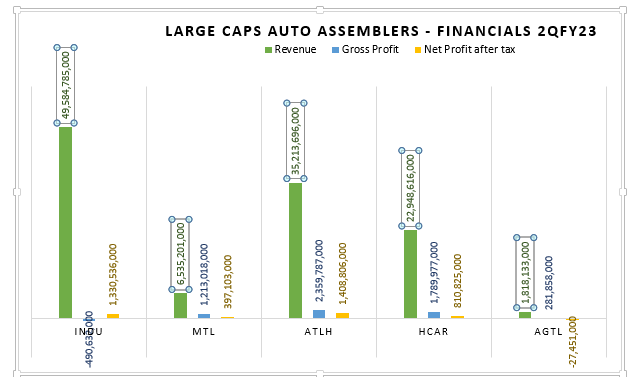

Financial comparison shows that large auto firms were hit hard by the high cost of production in 2QFY23, resulting in quite low gross profits. In 2QFY23, INDU topped the peer companies by grabbing highest quarterly sales of Rs49 billion followed by ATLH with sales of Rs35 billion. HCAR came in as the third highest revenue collector with sales of Rs22 billion. MTL’s sales in the second quarter of FY23 were Rs6.5 billion, whereas AGTL made lowest revenue of Rs1.8 billion in 2QFY23.

In terms of gross profit, ATLH posted the highest gross profit of Rs2.3 billion in 2QFY23. HCAR posted gross profit of Rs1.7 billion and MTL declared Rs1.2 billion. AGTL posted Rs281 million gross profit and INDU bore gross loss of Rs490 million in second quarter of FY23. In terms of net profit-making, large cap auto firms remained under-performed in 2QFY23. ATLH posted the highest net profit of Rs1.4 billion followed by INDU and HCAR with net profits of Rs1.3 billion and Rs810 million, respectively. MTL posted lowest net profit of Rs397 million in 2QFY23 while AGTL declared net loss worth Rs27 million.

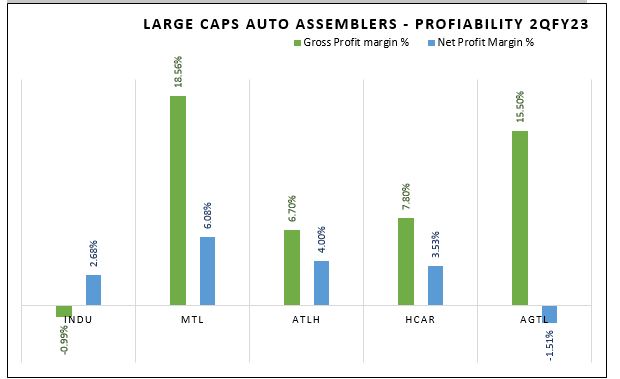

Large Auto Assemblers – Profitability Ratios – 2QFY23

MTL posted the highest gross profit (GP) and net profit (NP) ratios of 18.56% and 6.08%, respectively. AGTL posted the second highest GP ratio of 15.50%, HCAR 7.08% and ATLH 6.70%. INDU reported gross loss ratio of 0.99% in 2QFY23.

ATLH posted the second highest NP ratio of 4% followed by HCAR and INDU of 3.53% and 2.68%, respectively. However, AGTL reported net loss ratio of 1.51% in 2QFY23.

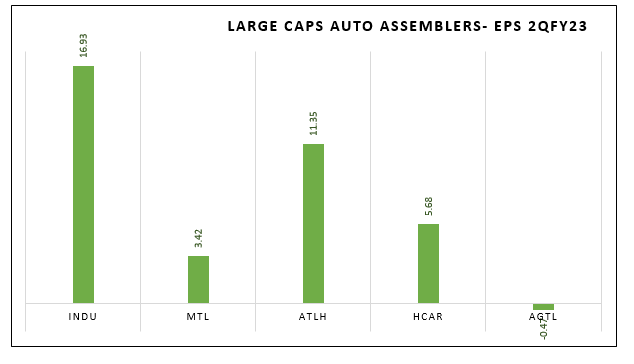

Large Auto Assemblers – EPS Comparison – 2QFY23

INDU posted the highest earnings per share of Rs16.93 in 2QFY23 followed by ATLH’s Rs11.35.

By posting EPS of Rs5.68, HCAR ranked the third. The lowest EPS was reported by MTL, while AGTL posted loss per share of Rs0.47 in 2QFY23.

Credit : Independent News Pakistan-WealthPk