INP-WealthPk

Jawad Ahmed

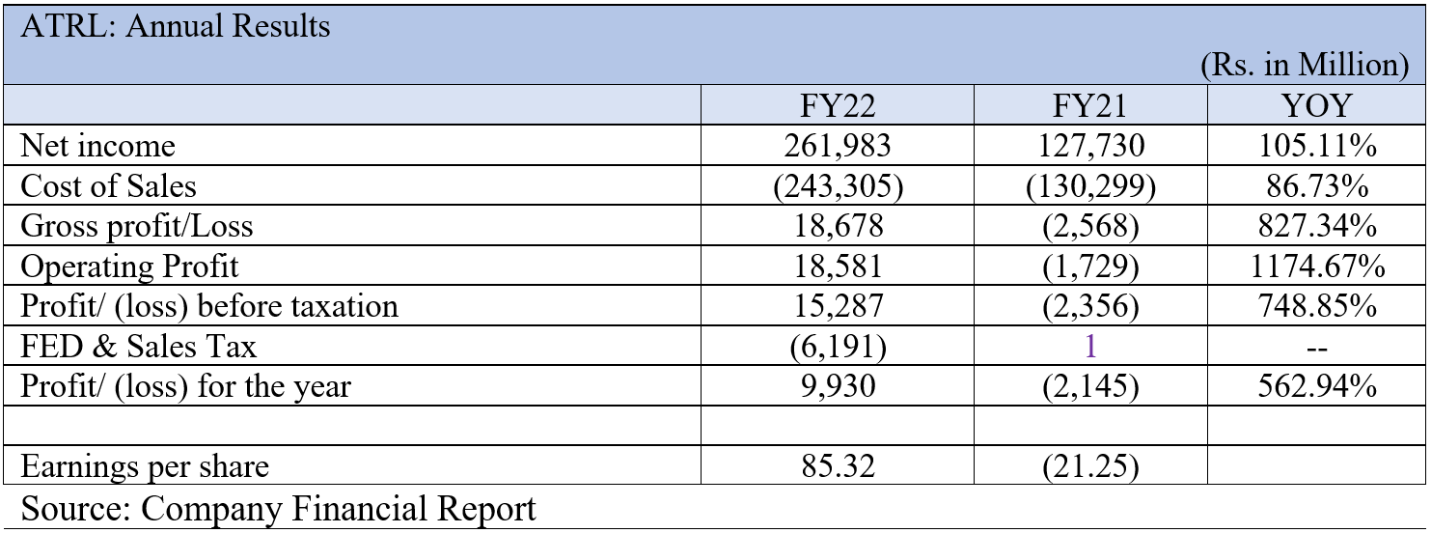

After four years of losses, Attock Refinery Limited’s net profit jumped to Rs9.930 billion in the financial year 2021-22 compared to a loss of Rs2.145 billion in fiscal 2020-21, reports WealthPK, quoting the latest financials filed by the company with the stock exchange.

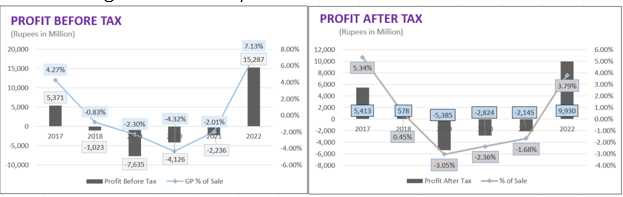

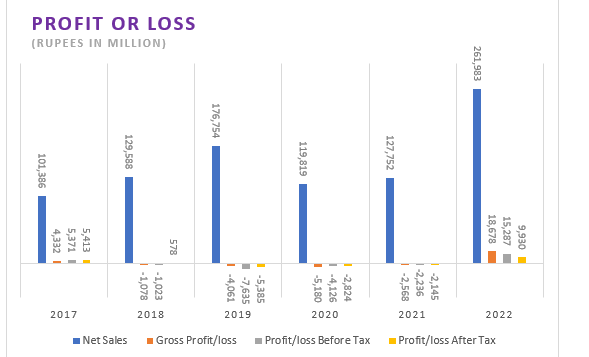

The net revenues of the company more than doubled to Rs261.98 billion in FY22 from Rs127.73 billion in FY21. The company also overcame gross losses amounting to Rs2.568 billion in FY21 and posted a huge gross profit of Rs18.68 billion in FY22 at a mind-boggling 827% growth rate. Similarly, the company posted robust Rs15.287 billion in profit-before-tax during FY22, recovering from a considerable loss of Rs2.356 billion in FY21, again showing a high growth rate of 749%.

Historical financial performance

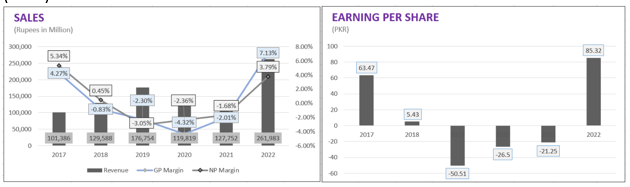

In 2018, the company achieved sales worth Rs129.588 billion, 27.8% higher than the previous year’s Rs101.386 billion. However, the gross profit fell by 125% from Rs4.332 billion in 2017 to Rs1.078 billion in 2018, and the profit-after-tax registered a massive decline of 836% to Rs578 million compared to a hefty net profit of Rs5.413 billion in 2017. The decline in the profit pulled down the earnings per share (EPS) to Rs5.43 in 2018 from Rs63.47 in 2017.

In 2019, the total sales revenue of the company kept increasing to Rs176.754 billion from Rs129.588 billion the previous year. However, the company saw its gross losses massively increase to Rs4.061 billion from Rs1.078 billion in 2018. Similarly, the company’s net loss also skyrocketed to Rs5.385 billion compared to a net profit of Rs578 million the previous year. This steep decline in profit pushed the EPS for the year into the negative territory at Rs50.51.

In 2020, due to the Covid-19 pandemic and the challenging economic situation, the company’s sales plunged 17.3% to Rs119.819 billion from Rs176.754 billion the previous year. As a result, the gross losses of the company also increased to Rs5.180 billion from Rs4.061 billion previously. However, the company managed to almost halve its loss-after-tax to Rs2.824 billion from loss of Rs5.385 during the previous year. Resultantly, the loss per share dropped to Rs26.5 from Rs50.51 the previous year.

In the year 2021, the revenue increased 6.62% to Rs127.752 billion from Rs119.819 in 2020. The gross losses also declined by almost half to Rs2.568 billion from the previous year’s Rs5.180 billion. The company recorded a loss-before-tax of Rs2.236 billion compared to Rs4.126 billion the previous year. During the year, the company’s loss-after-tax further dropped to Rs2.145 billion from Rs2.824 billion the previous year. As a result, the loss per share also further dropped to Rs21.25 from the previous year’s Rs26.5.

Credit: Independent News Pakistan-WealthPak