INP-WealthPk

Qudsia Bano

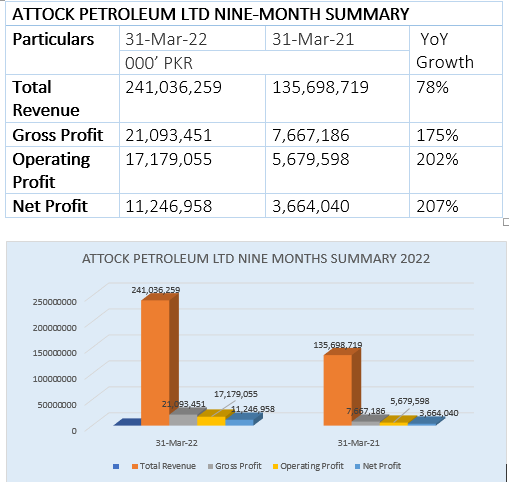

Attock Petroleum Limited’s revenue climbed 78% to Rs241 billion in the first nine months of the financial year 2021-22 compared with Rs135.7 billion in the corresponding period of fiscal 2020-21. Similarly, the gross profit of the company grew by 175% during the nine-month period of FY22 to Rs21.1 billion from Rs7.7 billion in the corresponding period of FY21. The net income also massively increased by 207% to Rs11.2 billion compared with a profit of Rs3.7 billion in the corresponding period of FY21, reports WealthPK.

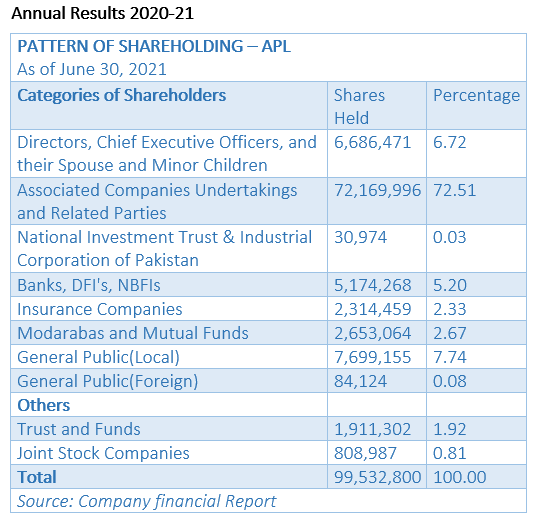

As of June 30, 2021, directors, chief executive officers, their spouses and minor children owned 6.72% of the company’s shares. Associated companies, undertakings and related parties owned 72.51% of the shares, while banks, development financial institutions and non-banking financial institutions owned 5.20%. Insurance companies held 2.33% of the shares, modarabas and mutual funds 2.67%, general public (local) 7.74%, trusts and funds 1.92%, and joint stock companies 0.81%.

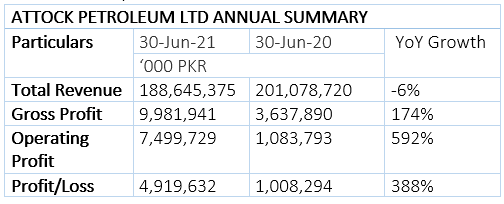

Financial Performance in 2020-21

During the fiscal year 2020-21, the company’s net sales revenue decreased by 6% to Rs188.6 billion from Rs201.1 billion in 2019-2020. The gross profit for FY21 stood at Rs9.98 billion, 174% up from Rs3.6 billion in FY20. Profit-after-tax peaked at Rs4.9 billion, showing an increase of 388% over the profit of over Rs1 billion in FY20.

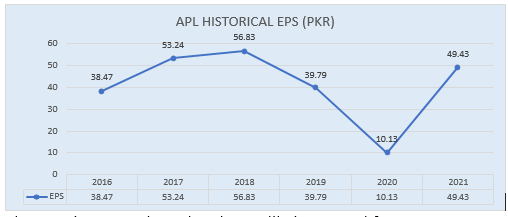

Earnings Per Share

The earnings per share (EPS) steadily increased from 2016 to 2018, before dropping to Rs39.79 in 2019. It further plunged to Rs10.13 in 2020, before ballooning to Rs49.43 in 2021. Attock Petroleum Limited was established in Pakistan as a public limited company on December 3, 1995, and its operations began in 1998. The company's main business is the purchase, storage, and sale of petroleum and related products.

Credit: Independent News Pakistan-WealthPak