INP-WealthPk

Fakiha Tariq

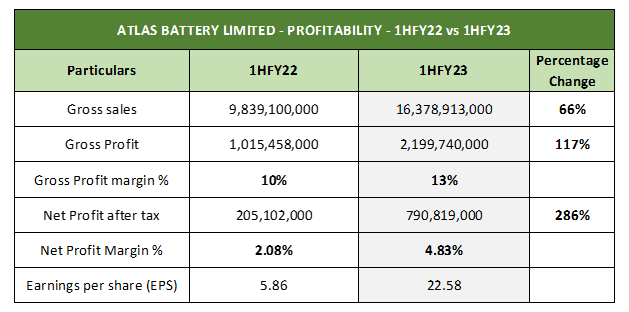

Atlas Battery Limited (ATBA) posted 66% growth in revenue and a 117% increase in gross profit during the first six months (July-December) of the current financial year 2022-23 compared to the same period of the last fiscal, WealthPK reports. ATBA posted Rs16 billion gross sales and Rs2.1 billion gross profit during the six-month period. The company posted a revenue of Rs9.8 billion and gross profit of Rs1 billion over the corresponding period of FY22. Thus, the gross profit ratio moved up to 13% in 1HFY23 from 10% in 1HFY22.

In 1HFY23, the company’s net profit leapt by 286% to Rs790 million from just Rs205 million in 1HFY22. The net profit ratio moved up from 2.08% in 1HFY22 to 4.83% in 1HFY23. The battery maker is listed on the Pakistan Stock Exchange with the symbol ATBA in the automobile accessories and parts sector.

With a market capitalisation of Rs6 billion, ATBA is the second-largest company in the sector. Incorporated as a public limited company in 1966, ATBA is primarily engaged in the production and selling of batteries for household and automotive use.

Quarterly Review

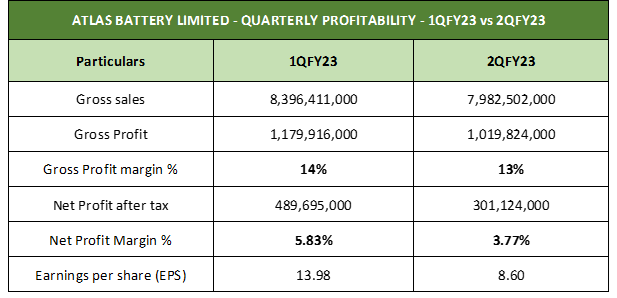

In the first quarter (July-September) of FY23, ATBA posted gross sales of Rs8.3 billion, gross profit of Rs1.1 billion and net profit of Rs489 million with gross and net profit ratios calculated at 14% and 5.83%, respectively. ATBA reported an earnings per share value of Rs13.98 in 1QFY23.

However, in the second (October-December) quarter of FY23, ATBA’s revenue decreased to Rs7.9 billion, gross profit to Rs1 billion and net profit to Rs301 million with gross profit and net profit rations turning out to be 13% and 3.77%, respectively. The company’s EPS value in 2QFY23 stood at Rs8.60.

Market Value Review – 1HFY23

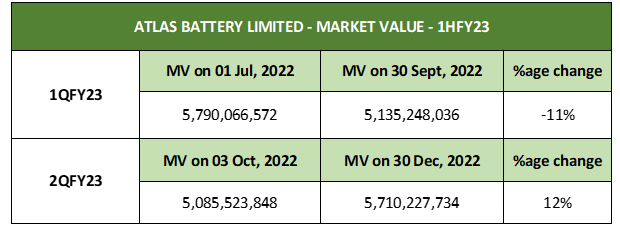

Overall, ATBA bore a minimal loss of 1% in its market value in the first half of FY23. `

In the first quarter of FY23, ATBA’s market value dropped by 11% from Rs5.7 billion to Rs5.1 billion. However, the company bounced back in the second quarter and posted a 12% gain in its market value. In 2QFY23, the market value of ATBA increased to Rs5.7 billion from Rs5 billion.

Credit : Independent News Pakistan-INP