INP-WealthPk

Jawad Ahmed

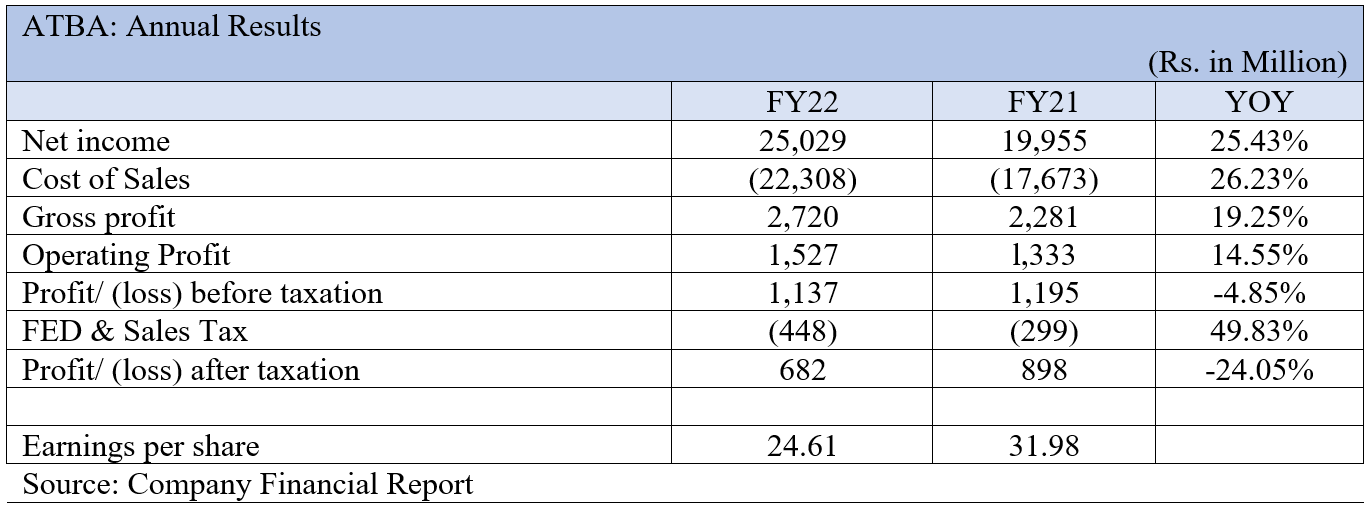

The revenues of Atlas Battery Limited – the manufacturer and seller of automotive and motorcycle batteries and allied products – increased 25.43% in the financial year ending June 30, 2022 to Rs25 billion from Rs19.9 billion the year earlier, according to the company’s latest financials filed with the stock exchange.

Despite a healthy growth in the top-line, the high costs of sales and federal taxes reduced the profit margins as the profit-after-tax fell 24% to Rs682 million from Rs898 million in the two comparable periods, reports WealthPK, quoting the company’s financial stats.

Historical financial performance

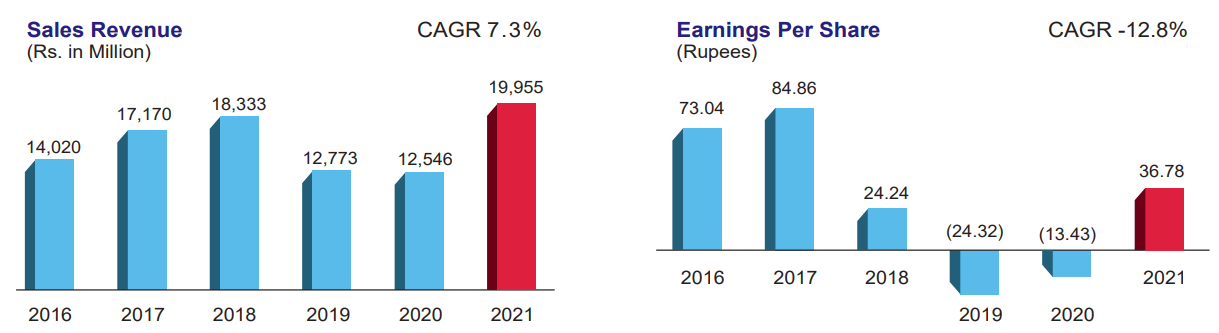

In 2019, the total sales revenue of the company decreased to Rs12.77 billion from Rs18.33 billion of the previous year.

The company also saw its gross profit plunge to Rs266 million from Rs879 million the previous year.

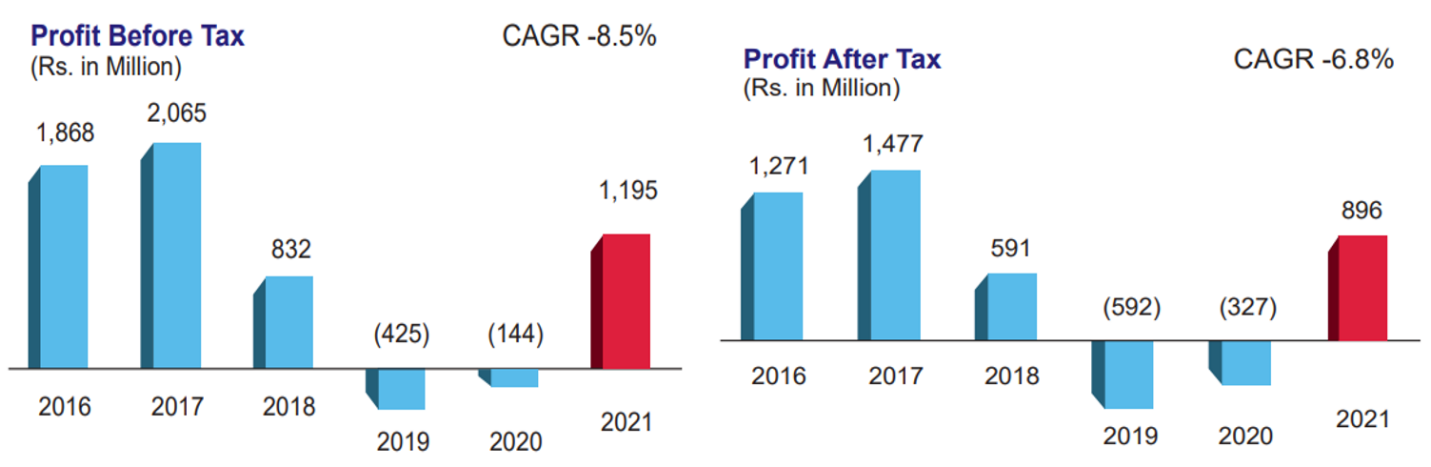

The company suffered a net loss of Rs592 million in 2019 compared to a net profit of Rs591 million the previous year. This decline in profit also pushed the EPS for the year into negative territory.

During 2020, sales of the company declined 1.8% to Rs12.54 billion as opposed to Rs12.77 billion in 2019. This was mostly caused by the Covid-19 epidemic, which had a negative impact on replacement market sales.

However, a 6.7% drop in cost of sales from Rs12.5 billion to Rs11.7 billion led to a gross profit of Rs879 million, up 229.7% from Rs267 million the previous year.

The loss-before-tax of Rs425 million in 2019 decreased to Rs144 million in 2020. After having deducted Rs183 million in taxes, the company bore the net loss of Rs327 million in 2020, down from Rs592 million the year before.

Loss per share thus decreased to Rs13.43 from Rs24.32 last year.

During 2021, the company achieved healthy sales of Rs19.95 billion compared to Rs12.54 billion in 2020, showing a 59.1% growth thanks to an overall increase in market size.

The increase in volume and greater fixed cost absorption led to a 159.6% increase in gross profit, taking it to Rs2.28 billion from Rs879 million the prior year.

Profit-before-tax stood at Rs1.19 billion in 2021 as opposed to a loss of Rs144 million the year before. The profit-after-tax for this year stood at Rs896 million minus taxes of Rs299 million, as opposed to the loss of Rs327 million of the previous year.

Earnings per share shed the negative trend and leapt to Rs36.78 from loss per share of Rs13.43 in 2020.

Credit : Independent News Pakistan-WealthPk