INP-WealthPk

Qudsia Bano

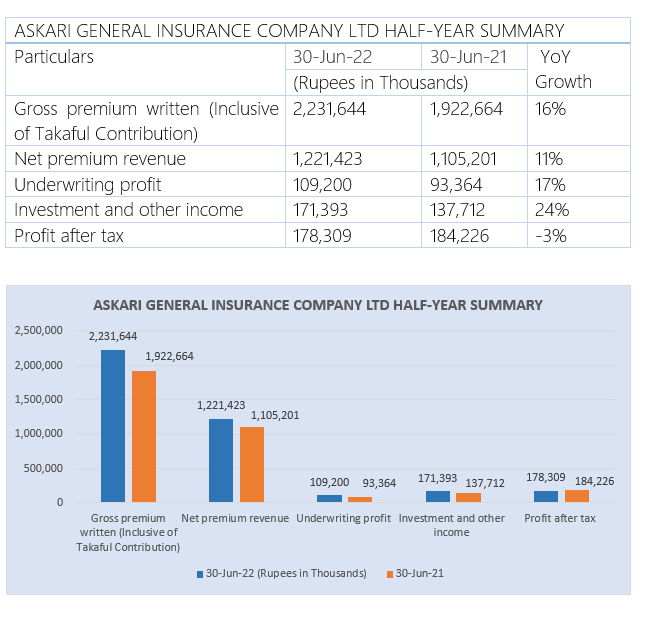

Askari General Insurance Company Ltd’s gross premium written (inclusive of Takaful contribution) grew 16% to Rs2.2 billion in the first six months of CY2022 ending June 30 compared with Rs1.92 billion in the corresponding period of 2021, reports WealthPK.

Similarly, the net premium revenue grew 11% to PKR1.2 billion during the six months of CY2022 compared with PKR1.1 billion in the corresponding period of the previous year.

The underwriting profit also increased 17% to PKR109 million compared with PKR93.3 million in June 2021. Investment and other income rose 24%, but profit after tax fell by 3% due to inclusion of 4% super tax under the finance plan for 2022–2023 (i.e. the super tax).

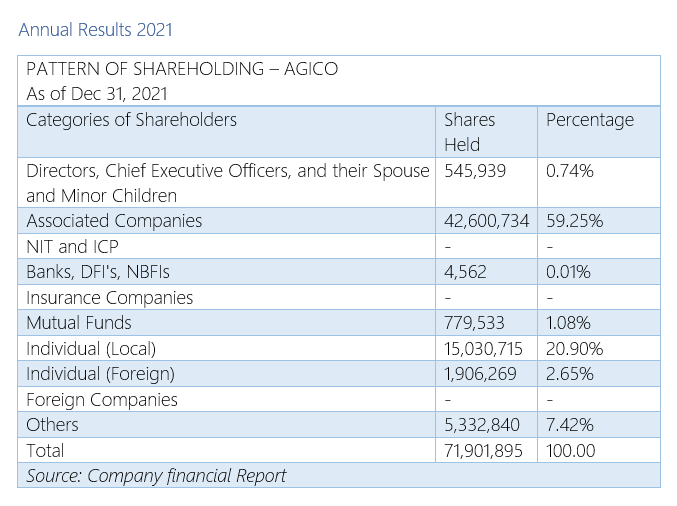

As of Dec 31, 2021, directors, chief executive officers, and their spouses and minor children owned 0.74% of the company’s shares, associated companies 59.25%, banks, development financial institutions, and non-banking financial institutions 0.01%, mutual funds 1.08%, individual (local) held 20.90%, individual (foreign) 2.65% and others 7.42%.

Financial performance

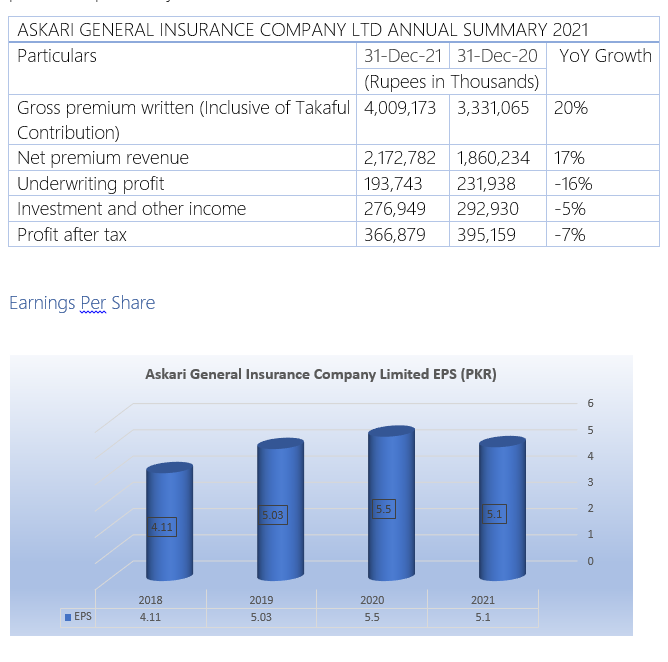

During the CY2021, the company registered gross premium written of PKR4 billion with an increase of 20% as against PKR3.3 billion in CY2020. The net premium revenue for the year 2021 was PKR2.2 billion, 17% up from PKR1.86 billion in the previous year. The profit after taxation for the CY2021 was PKR366 million with a decrease of 7% compared to PKR395 million in the corresponding period the previous year.

The EPS of the company witnessed a mix of trends during the recent years. In 2018, the EPS stood at PKR4.11 and then increased to PKR5.5 in 2020. However, the EPS dropped to PKR5.1 in 2021. Askari General Insurance Company Limited was established as a public limited company on April 12, 1995 under the Companies Ordinance, 1984 (repealed on May 30, 2017, with the passage of the Companies Act, 2017). The company operates in the non-life insurance sector, which includes fire, marine, automobile, health, and other insurances. The company is an Army Welfare Trust's subsidiary.

Credit : Independent News Pakistan-WealthPk