INP-WealthPk

Hifsa Raja

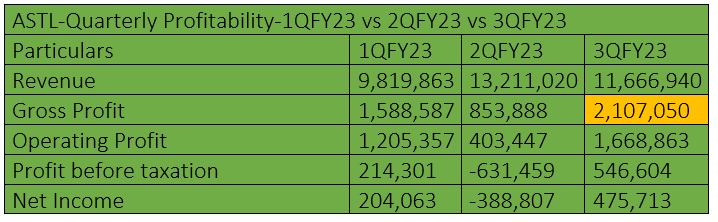

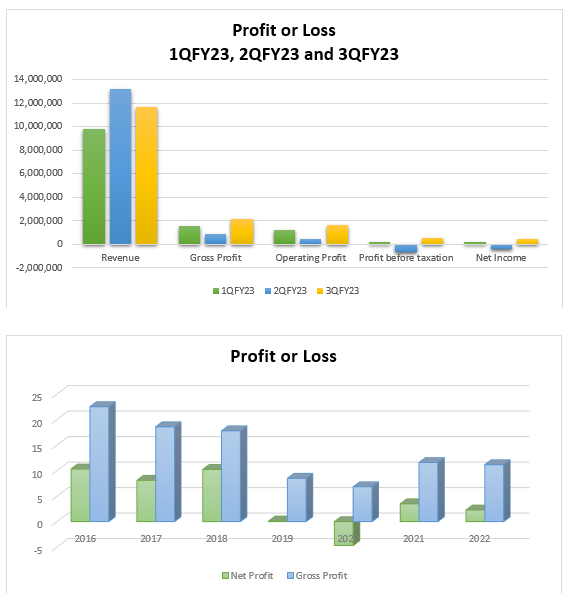

Amreli Steels Limited (ASTL) enjoyed gross profits in the first three quarters of the ongoing fiscal year 2022-23, but bore net loss in the second quarter (October-December). In the first quarter (July-September), ASTL posted gross revenue of Rs9.8 billion, gross profit of Rs1.5 billion and net profit of Rs204 million.

In the second quarter (October-December), ASTL posted a gross revenue of Rs13.2 billion – the highest of the ongoing fiscal – and a gross profit of Rs853 million. However, the company posted a net loss of Rs388 million during this period. In the most recent (January-March) quarter, the company posted gross revenues of Rs11.6 billion and a gross profit of Rs2.1 billion. The company posted a net profit of Rs475 million.

Year-on-year comparison

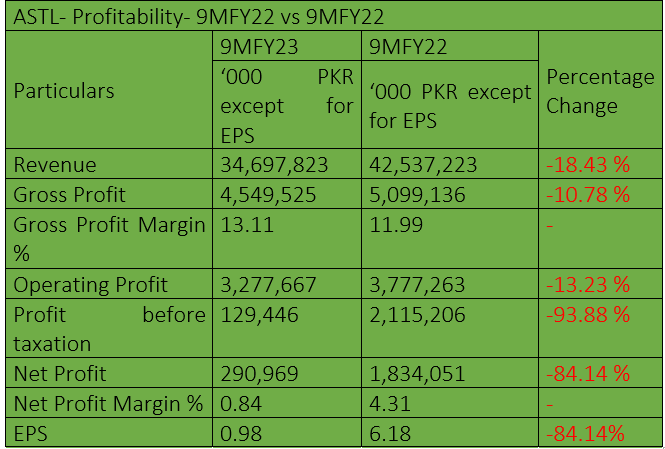

Amreli Steels’ revenue decreased 18% to Rs34 billion in the first nine months of FY23 from Rs42 billion over the corresponding period of FY22. The company’s gross profit declined 10% to Rs4.5 billion from Rs5.09 billion previously. The operating profit also decreased 13% to Rs3.2 billion from Rs3.7 billion previously. The net income decreased 84% to Rs290 million in 9MFY23 from Rs1.8 billion over the corresponding period of FY22. The earnings per share (EPS) decreased 84% to Rs0.98 in 9MFY23 compared to Rs6.18 in 9MFY22.

EPS forecast

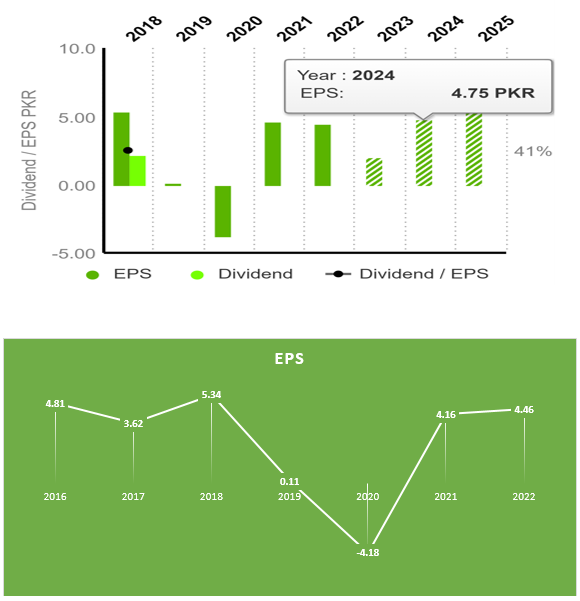

Based on the current performance, ASTL’s EPS is likely to increase to Rs4.75 in FY24 and to Rs7.9 in FY25.

The EPS witnessed a mix trend during recent years. In 2018, the EPS showed remarkable growth and reached Rs5.34. But the company suffered a loss per share of Rs4.18 in 2020. However, the EPS registered gains and stood at Rs4.16 in 2021, and further inched up to Rs4.46 in 2022.

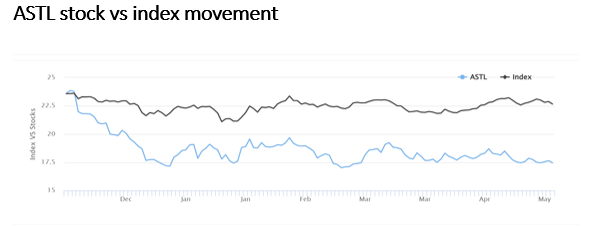

Market capitalisation in three quarters of FY23

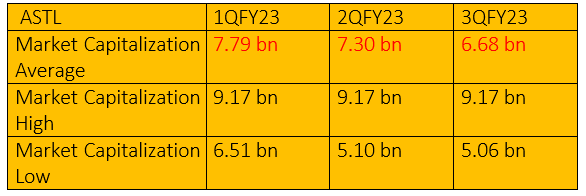

ASTL’s market capitalisation stood at Rs7.79 billion in 1QFY23, but decreased to Rs7.30 billion in 2QFY23 and to Rs6.68 billion in 3QFY23.

ASTL had the highest market capitalisation of Rs27.52 billion in 2018, which decreased to Rs11.28 billion in 2022. It had the lowest market cap of Rs8.98 billion in 2020.

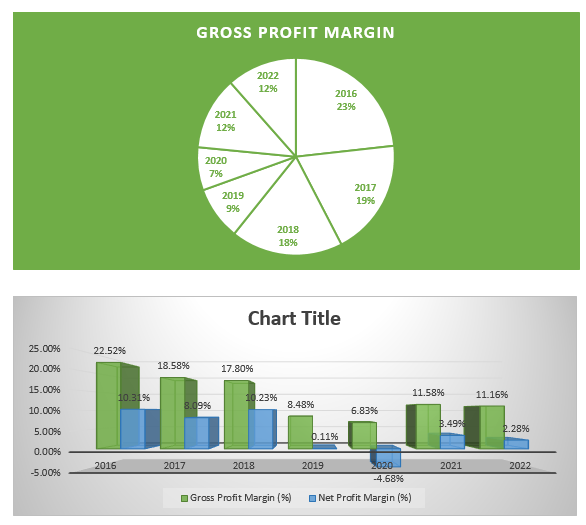

Ratio analysis

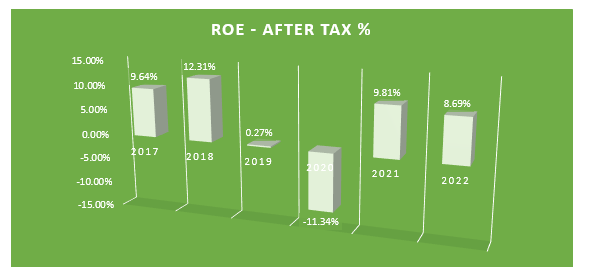

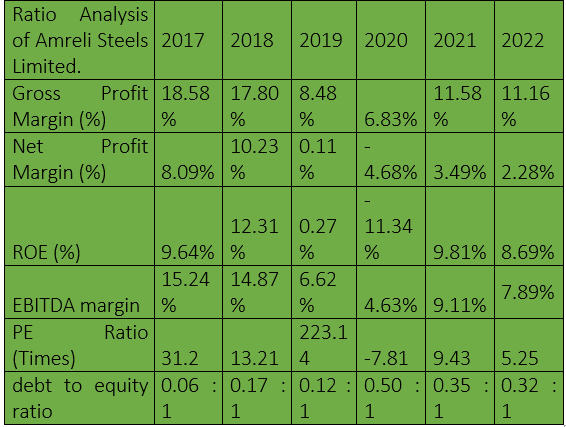

The company’s gross profit margin stood at 18.58% in 2017, demonstrating that it managed to keep in check the costs of delivering its goods and services. The net profit margin stood at 8.09%. The company’s return on equity (RoE) for 2017 stood at 9.64%, indicating effective management in terms of producing a return on investments.

In 2018, the company’s gross profit, net profit margins and RoE stood at 17.80%, 10.23%, and 12.31%, respectively, indicating the firm performed well. In 2019, the gross profit margin fell to 8.48%, net profit margin to 0.11% and RoE to 0.27%, indicating the incurrence of costs other than the cost of goods sold. However, the profitability increased in 2021 with RoE increasing to 9.81%, gross profit to 11.58% and net profit to 8.49%. In 2022, the company’s gross profit margin slightly decreased to 11.16% and net profit margin to 2.28%. RoE also dropped to 8.69% in 2022.

The company's operating efficiency is demonstrated by the EBITDA (earnings before interest, taxes, depreciation and amortisation) margin. The lower operating expenditures in 2017 and 2018 were caused by greater EBITDA margin. However, rising operational costs in 2019 and 2020 resulted in lower profitability. EBITDA rose in 2021, but fell in 2022.

The price-to-earnings (PE) ratio stood at 31.27 times in 2017, which showed a high expectation for future growth. PE ratio decreased the next year. In 2019, there was an increase of 223.14 times. In 2021, there was a sudden decrease in the PE ratio, showing a low stock market value for Amreli Steels Limited. In 2021, the stock value increased 9.43 times. In 2022, the PE ratio again decreased to 5.25 times.

The debt-to-equity ratio shows that the company had a debt of 0.06% in 2017, which increased to 0.17% in 2018. In 2019, the debt decreased to 0.12%. In 2020, the company sustained debt of 0.5%. In 2021, it took 0.35% of the debt.

Profit or loss over the years

ASTL’s gross and net profits remained low in 1QFY23 and 3QFY23. The company faced net and gross losses in 2QFY23.

The profitability was high in 2017 and 2018, whereas in 2019 and 2020, the gross and operating profits decreased. In 2021, the gross and operating profits along with net income increased. While the profitability was strong in 2016, 2017 and 2018, it declined in 2019 and 2020 as a result of falling net and gross profit margins. In 2021 and 2022, gross profit was higher, but net profit was lower particularly in 2022. Overall, the company fared well in 2022.

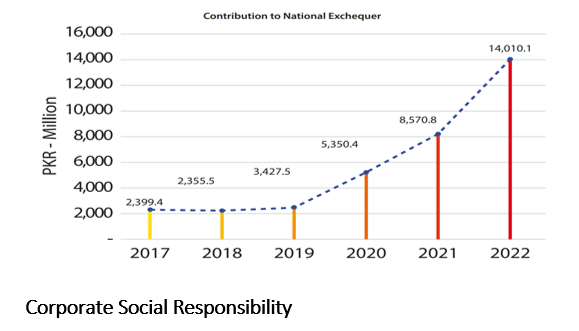

Contribution to national exchequer

On account of various government levies, taxes and import duties, Amreli Steels contributed Rs14 billion to the national exchequer in FY22 against Rs8.57 billion in FY21, posting 61.7% increase year-on-year.

Amreli Steels has always placed a greater emphasis on giving back to the community, committed to raising the living conditions of both its employees and the general public under Corporate Social Responsibility mechanism.

Introduction of green energy

The company also plans to introduce green energy to help reduce its carbon footprint.

Exports

The company exports aluminum products, thus playing a good part in boosting the revenue sources for the country. The company had export sales of Rs57.9 million in FY22 compared to export proceeds of Rs70 million in 2021. It exports its products to South Korea.

Company profile

Amreli Steels Limited is engaged in the manufacture and sale of steel bars and billets. The company’s products include Amreli Steels’ Maxima bars, Amreli Steels’ Ultima bars and Amerli Steels’ Xtreme bars. The company offers a range of steel bars across residential, commercial and mega infrastructure projects. The company operates two re-rolling plants located at S.I.T.E. Karachi and Dhabeji, Sindh. Its steel melt shop plant in Dhabeji produces billets in sizes ranging from approximately 100 x 100-millimeter square to 200 x 200 mm sq.

Credit: Independent News Pakistan-WealthPk