INP-WealthPk

Qudsia Bano

Al Shaheer Corporation Limited, a prominent player in the meat processing industry, recently announced its financial performance for the three-month and nine-month periods ending March 31, 2023. The company showcased an impressive recovery compared to the same period last year, posting substantial growth and turning losses into profits. According to an official of the company, the overall turnover climbed by 19% in the third quarter of the current fiscal year (FY23) in comparison to the same quarter last year. “The institutional sales sector's rapid expansion is the primary driver of the rise, followed by the income from recently-launched frozen food company.”

The official said the company saw an unprecedented rise in finance and material costs. He said the company’s margins were negatively impacted by growing utility and logistics costs during this time period, which resulted in overall losses. “Despite the difficulties, the company remained dedicated to enhancing customers' quality of life by broadening its product line through the ongoing innovation and refurbishment,” said the official.

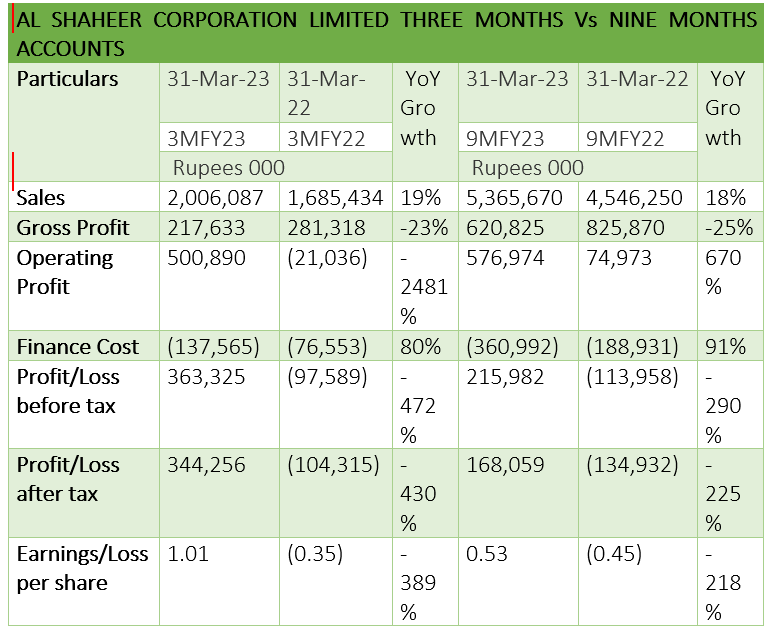

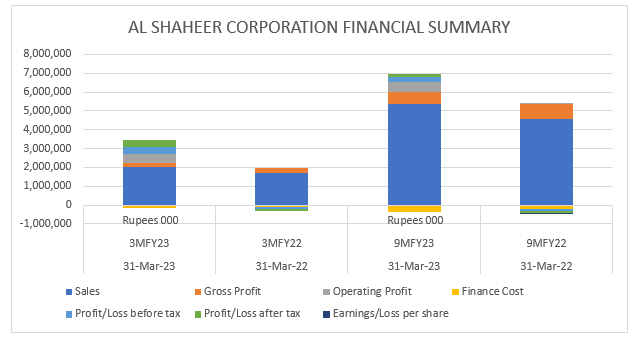

Al Shaheer Corporation reported sales of Rs2 billion for the three months ending March 31, 2023 (3QFY23), reflecting a substantial 19% increase compared to the corresponding period of the previous fiscal. This robust growth can be attributed to the company's strategic initiatives and expansion of its customer base. However, the gross profit figures showed a decline, with the company generating Rs217 million in 3QFY23, down by 23% from Rs281 million in 3QFY22. Despite this setback, Al Shaheer Corporation demonstrated its resilience and ability to navigate challenging market conditions.

The company’s operating profit witnessed a significant turnaround, reaching Rs500 million in the three-month period, a notable improvement from the loss of Rs21 million reported in the same period last year. This impressive recovery indicates the effectiveness of the company's cost management measures and operational efficiencies.Finance costs incurred by the corporation amounted to Rs137 million, representing an 80% increase compared to the previous year's Rs76.6 million. Despite this rise, the company's ability to generate profits and cover these costs showcases its resilience in managing financial obligations.

The company reported a profit-before-tax of Rs363 million for the three-month period, a stark contrast to the loss of Rs97.6 million incurred the previous year. This improvement demonstrates the company’s successful implementation of its strategic plans and its ability to adapt to changing market dynamics. Furthermore, the company achieved a remarkable turnaround by recording a profit-after-tax of Rs344 million compared to a loss of Rs104.3 million in the same period last year. This positive outcome highlights the company's effective financial management and strong performance. Al Shaheer Corporation's earnings per share (EPS) for the three-month period stood at Rs1.01 compared to a loss per share of Rs0.35 the previous year, representing a significant improvement of 389%.

The company displayed significant growth in its nine-month financial results for the period ending March 31, 2023 (9MFY23), compared to the same period last year, with an 18% increase in sales. Despite a 25% decrease in gross profit, Al Shaheer Corporation witnessed a substantial improvement in the operating profit, which soared by 670%. Finance costs also rose by 91%, while the company managed to turn losses into a profit-after-tax, albeit with a decline of 225%. The company’s EPS improved by 218%. Overall, the results showcase the company's resilience and strategic efforts to steer toward profitability amidst market challenges.

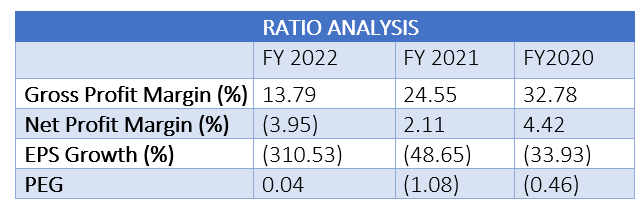

In FY22, Al Shaheer Corporation experienced a decline in its gross profit margin, which stood at 13.79% compared to 24.55% in FY21 and 32.78% in FY20. The decrease indicates a lower percentage of sales revenue retained after accounting for the cost of goods sold. Similarly, the company's net profit margin showed a negative figure of -3.95% in FY22, signifying that the company incurred a loss in relation to its total sales. This is in contrast to the net profit margin of 2.11% in FY21 and 4.42% in FY20, indicating a decline in profitability. The EPS growth rate for FY22 saw a significant decrease of 310.53%.

The price/earnings growth ratio (PEG) for FY22 was positive at 0.04, suggesting a potential undervaluation of the company's stock. This contrasts with the negative PEG values of -1.08 in FY21 and -0.46 in FY20, implying an overvaluation of the stock relative to its earnings growth rate in those years. Overall, these ratios demonstrate a challenging financial performance for Al Shaheer Corporation in FY22, characterised by lower profitability and negative EPS growth.

Share Price Analysis

The share price of Al Shaheer Corporation exhibited a fluctuating pattern over the given period. Starting at Rs10 in early January 2023, the price experienced minor variations, briefly peaking at Rs10.58 in mid-February before settling within a range between Rs9 and Rs10. However, in late March, the share price faced a sharp decline, reaching as low as Rs8.75, before rebounding to Rs9.5 by the end of the month. This price volatility suggests that the stock experienced market uncertainty and investor indecision during this period.

Credit: Independent News Pakistan-WealthPk