INP-WealthPk

Hifsa Raja

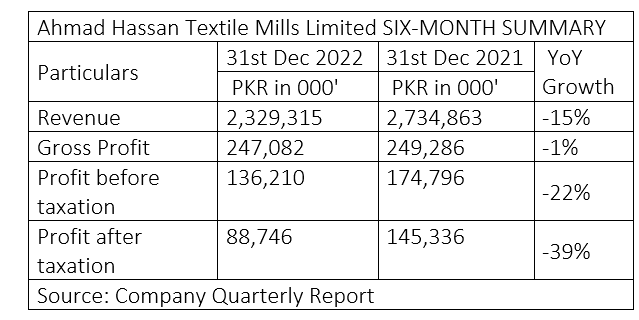

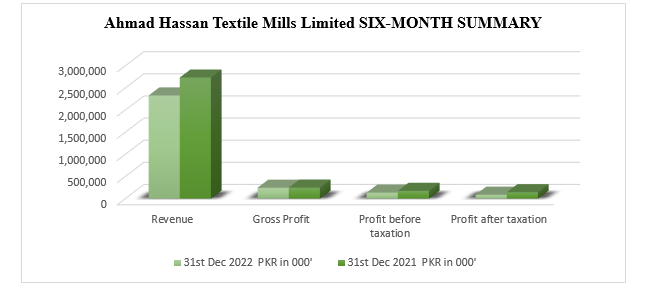

Ahmad Hassan Textile Mills Limited’s revenue decreased 15% to Rs2.3 billion in the first half (July-December) of the ongoing fiscal year 2022-23 from Rs2.7 billion in the corresponding period of the previous year.The company’s gross profit declined 1% to Rs247 million in 1HFY23 from Rs249 million in the corresponding period of FY22.

The profit-before-taxation also dropped to Rs136 million in 1HFY23 from Rs174 million in 1HFY22, registering a negative growth of 22% year-on-year. Similarly, the profit-after-taxation decreased 39% to Rs88 million in 1HFY23 from Rs145 million in 1HFY22, reports WealthPK.

Overall, the decrease in revenue and profits for Ahmad Hassan Textile Mills Limited is a cause for concern, and it will be important for the company to take proactive steps to address this trend in the coming months. The company may need to adjust its operations or develop new strategies to maintain profitability and ensure its long-term success in a challenging market.

The management of the company has commissioned a solar system of 988.9KWP and plans to increase its capacity to 1MW. Despite increasing raw material prices, the company intends to improve sales, reduce costs, and maintain profitability. The move towards expanding renewable energy capabilities is commendable, as it supports sustainability and may reduce long-term costs. However, the company should carefully consider and manage any financial risks associated with the expansion.

Profitability

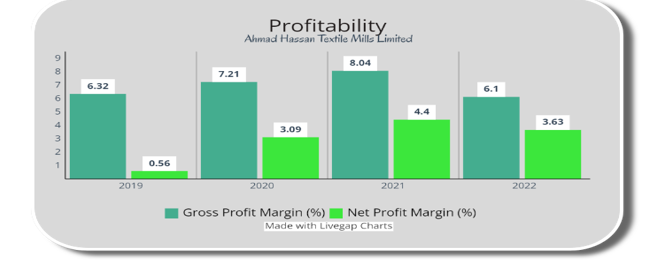

The company's gross profit margin increased steadily from 6.32% in 2019 to 8.04% in 2021, indicating that the company was able to manage its production costs efficiently. However, in 2022, the gross profit margin decreased to 6.1%, indicating that the company may have experienced a decrease in sales revenue.

The company's net profit margin also increased steadily from 0.56% in 2019 to 4.4% in 2021, indicating that the company was able to control its operating expenses and generate a higher profit for its shareholders. However, in 2022, the net profit margin decreased to 3.63%, suggesting that the company may have experienced an increase in operating expenses.

Overall, the trend in both gross profit and net profit margins indicates that the company has been able to manage its costs efficiently and generate higher profits over the past few years. However, the recent decrease in both margins in 2022 may be a cause for concern, and the company may need to evaluate its operations and financial performance to address any potential challenges.

Earnings growth analysis

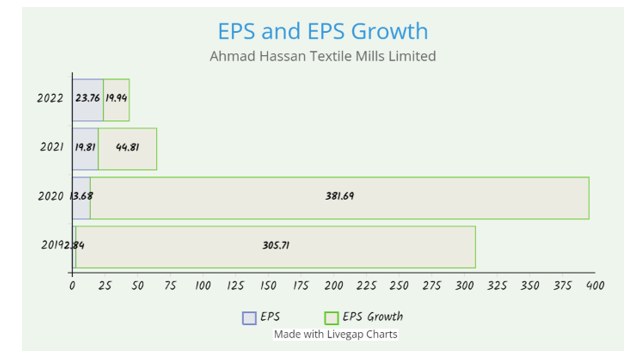

The EPS (earnings per share) for the company has shown significant growth over the past four years, with a staggering 305.71% growth in 2019 followed by similar 381.69% growth in 2020. This shows that the company generated more earnings per share during this period.

In 2021, the growth in EPS slowed down to 44.81%, which indicates that the company's growth rate began to level off. However, in 2022, the company saw a further fall in growth rate to 19.94%, meaning the company continued to generate more earnings per share. Overall, the trend in EPS growth suggests that the company has been performing well and has been able to consistently generate higher earnings for its shareholders.

Industry comparison

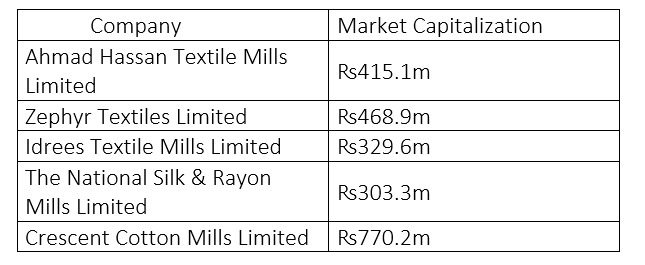

Ahmad Hassan Textile Mills Limited’s competitors include Zephyr Textiles Limited, Idrees Textile Mills Limited, The National Silk & Rayon Mills Limited, and Crescent Cotton Mills Limited.

Company profile

Ahmad Hassan Textile Mills Limited was incorporated in Pakistan on December 03, 1989 as a public limited company under the Companies Ordinance, 1984. It is principally engaged in manufacturing and sale of yarn and fabric. The company also started cotton ginning business by taking a ginning factory on lease from its associated undertaking.

Credit: Independent News Pakistan-WealthPk