INP-WealthPk

Qudsia Bano

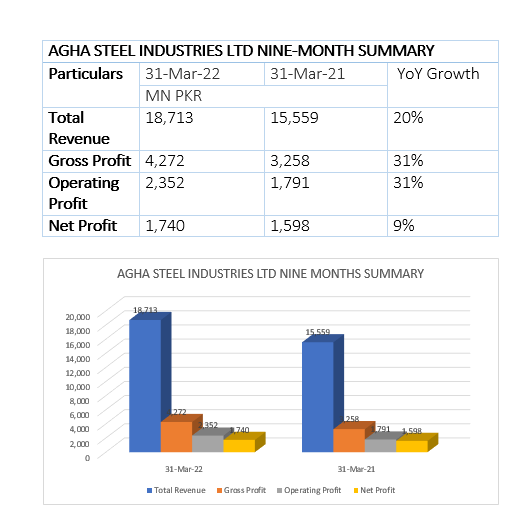

Agha Steel Industries Limited’s revenue climbed 20% to Rs18.7 billion in the first nine months ending March 31, 2022 (9MFY22), compared with Rs15.6 billion in the corresponding period of FY21.

Similarly, the gross profit of the company registered a growth of 31% during the 9MFY22 and stood at Rs4.2 billion compared to Rs3.3 billion in the corresponding period of the previous year. The net income increased 9% to Rs1.74 billion compared with a profit of Rs1.6 billion in the corresponding period of FY21, reports WealthPK.

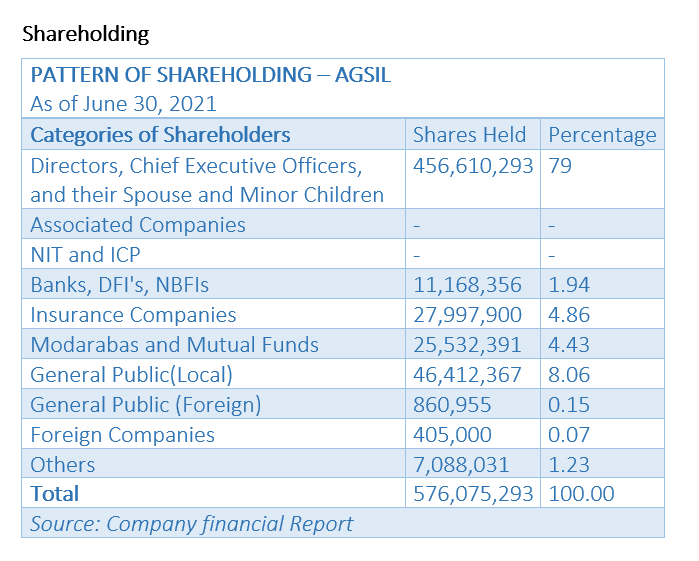

As of June 30, 2021, directors, chief executive officers, their spouses and minor children owned 79% of the company’s shares. Banks, Development Financial Institutions, and Non-Banking Financial Institutions owned 1.94% of the total shares of the company. Insurance companies held 4.86%, Modarabas and mutual funds 4.43%, general public (local) 8.06%, and ‘foreign’ 0.15%, foreign companies 0.07% and ‘others’ held 1.23% of the shares, respectively.

Financial Performance

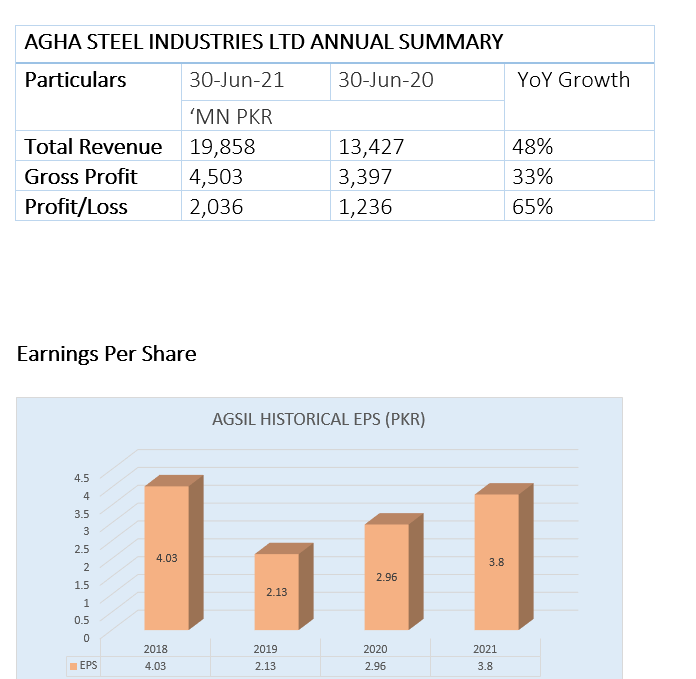

During the fiscal year 2020-21, the company maintained a strong sales trend, generating net sales revenue of Rs19.8 billion, with an increase of 48%, as against Rs13.4 billion in 2019-20. The gross profit for FY21 stood at Rs4.5 billion, 33% higher than Rs3.4 billion in FY20. Profit-after-taxation for the year stood at Rs2 billion, 65% higher than Rs1.2 billion in the corresponding period of FY20.

The earnings per share (EPS) of the company witnessed a mix trend during recent years as in 2018, the EPS stood at Rs4.03 before dropping to Rs2.13 in 2019, and then inching up to Rs2.96 in 2020 and Rs3.8 in 2021.

Agha Steel Industries Limited was established as a private limited company on November 19, 2013. On April 7, 2015, it was converted into a public limited company. The company's main business is the production and retail selling of steel bars, wire rods and billets.

Credit : Independent News Pakistan-WealthPk