INP-WealthPk

Irfan Ahmed

Pakistan Stock Exchange (PSX) showed a positive trend last week due to refinancing of $2.24 billion by China and $2.5 billion financial support by the Asian Development Bank (ADB) for relief in the wake of the recent devastating floods, reports WealthPK.

In the outgoing week, the market continued an upward trend, as China agreed to refinance a $2.24 billion loan and the government is in talks of rolling over SAFE China deposits of $2 billion.

Additionally, the trade deficit shrank 21.4% year-on-year from $11.72bn to $9.2 billion, which helped the index sustain momentum during the week. Furthermore, the rupee appreciated against the greenback, closing at 219.92 (up by PKR 8.53 | 3.7% week-on-week).

Moreover, the ADB announced around $2.3-2.5 billion in aid for relief in the wake of the recent flood disaster.

However, Moody’s downgraded Pakistan’s sovereign credit rating on Thursday from B3 to Caa1 due to increased liquidity and external vulnerability risks, keeping the bourse in check. That said, the market closed at 42,085 points, gaining 956 points (up by 2.32%).

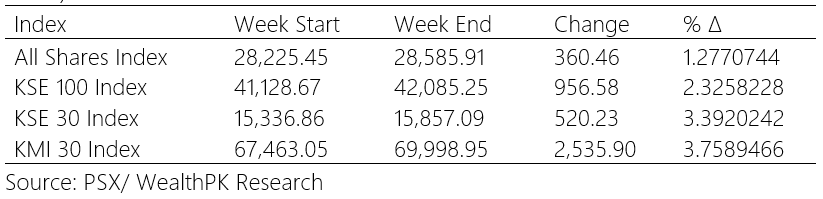

According to WealthPK analysis, the market gained 956.58 points throughout the week, closing at 42,085.25 points (up by 2.32%). The All-Share Index also increased by 360.46 points or 1.28%, the KSE 30 index surged by 520.23 points or 3.39%, and the KMI30 index increased by 2,535.90 points or 3.76% on a weekly basis.

In the meantime, average volumes clocked in at 434 million shares (up by 118% WoW), while the average value traded settled at USD 48 million (up by 32% WoW).

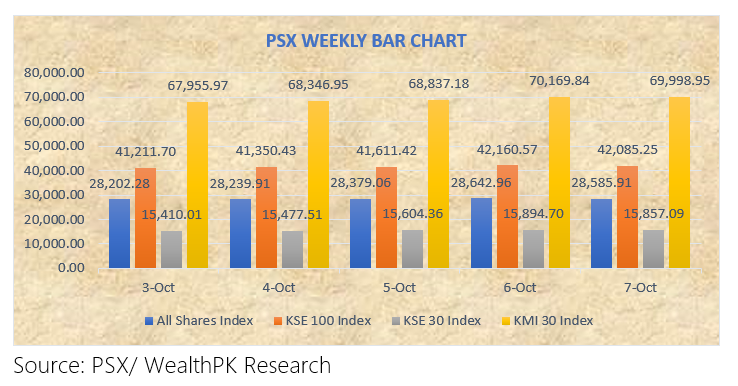

The PSX witnessed a bullish trend on Oct. 3, as the Pakistani rupee continued its upward momentum, rising by Rs1.16 against the dollar in the interbank market. By the end of the day, the KSE-100 index gained 83.03 points, a positive change of 0.20%, closing at 41,211.70 against 41,128.67 points on the last working day.

On Tuesday, Oct. 4, bulls dominated on the Pakistan stock market due to investor expectations regarding corporate results and a strengthening rupee against the US dollar. The benchmark KSE-100 index closed at 41,350.43 points with an increase of 138.73 points or 0.34%.

The PSX continued with a bullish trend on Wednesday, Oct. 5, as PKR continued its solidification against the US dollar, helping investors to remain affirmative in the market. The 100-index gained 260.99 points, a positive change of 0.63%, closing at 41,611.42 points.

Stocks gained 549.15 points on Thursday, Oct. 6, after the ADB announced provision of $2.3 billion. The benchmark KSE-100 index ended at 42,160.57 points, showing an increase of 1.32%.

The 100-index witnessed a bearish trend on Friday, Oct. 7, as Moody’s Investor Service downgraded Pakistan’s sovereign credit rating by one notch to Caa1 from B3. As a result, the KSE-100 Index finished the day with a loss of 75.32 points, a negative change of 0.18 percent, closing at 42,085.25 points.

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $4.70 million. Insurance Companies made the most money this week, selling their shares for $5.73 million, followed by banks/DFIs with $4.39 million and foreign corporates with $1.21 million.

Foreign individuals purchased up to $6.98 million in shares, followed by individuals and mutual funds purchasing $6.72 million and $0.27 million in stocks respectively.

According to Muhammad Irfan Ahmed, a financial analyst with Arif Habib Limited, the market is expected to remain positive in the upcoming week. With the Monetary Policy Committee (MPC) meeting on Monday, the market is expected to maintain the status quo, while the indication of a stable parity will also aid sentiment at the index.

Credit : Independent News Pakistan-WealthPk